Giving Options and Fund Types

Philanthropy, Your Way

With us, you can set up a charitable fund of your own and make a bigger impact with your giving. Our funds let you give in your own way, on your own timetable. Tell us what you're passionate about, and we'll take it from there.

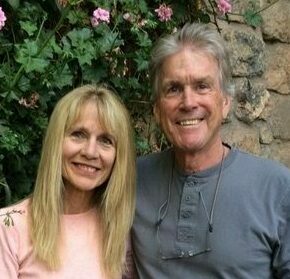

Tom and I have always believed in the importance of giving back to the community that has given us so much. The Izzo Legacy Endowment Fund provides us with an opportunity to formalize our commitment to making a difference and to inspire others to join us in this noble pursuit.

Tom and I have always believed in the importance of giving back to the community that has given us so much. The Izzo Legacy Endowment Fund provides us with an opportunity to formalize our commitment to making a difference and to inspire others to join us in this noble pursuit.

– Lupe Izzo, Founder of The Izzo Legacy

High Impact Funds:

Leadership Fund

To support the Community Foundation’s strategic initiatives, proactive grants, and related Community Foundation capacity needs. Projects like Rotary Park and Play Michigan! (the region’s first universally accessible playground-park) depended on this fund.

Community Needs Fund

Perpetual fund to support the charitable nonprofits and projects that meet the region’s current, greatest needs.

DEI Action Fund

With the help of a generous donor, we established the DEI Action Fund to support Diversity, Equity, and Inclusion programs and activities in our community.

Local Impact Investment Fund

Impact investments are a powerful way to support and improve communities - a way to generate financial return and provide social or environmental benefit.

General Fund Types:

Donor-advised funds eliminate the need for a private foundation. You focus on giving to nonprofits of your choosing; we take care of the paperwork.

Field of interest funds allow you to concentrate your giving on a particular issue or geographic area — such as ending hunger, protecting the environment, or supporting the arts.

Designated funds support your charitable organizations of choice.

Legacy (Testamentary) funds are funded through your planned gift. You are also invited to join our Legacy Society.

Agency endowment funds are set up by nonprofits to grow their assets and, in so doing, provide permanent sources of revenue for those organizations.

Leave Your Legacy

Planned giving integrates charitable giving with your overall financial and estate planning, potentially reducing your estate taxes while supporting your community.

- Bequests: Make a charitable gift from your estate with a simple bequest, as noted in your will or trust.

- Retirement assets: By making the Community Foundation the beneficiary of the most-taxed asset, your retirement account, you can leave more favorably-taxed property to your heirs.

- Life insurance: Simply make the Community Foundation the beneficiary of your policy. You give a significant gift to charity and receive tax benefits during your lifetime.

- Charitable lead trust: Place cash or property into a trust that pays a fixed amount to the Community Foundation for a specified number of years. Once this period ends, the assets held by the trust are transferred to the beneficiaries you name.

- Charitable remainder trusts: These gifts allow you to receive income for the rest of your life, knowing that whatever remains will benefit your community.

- Charitable gift annuities: Receive an income for life, while making an immediate, significant gift.

Also, when you establish a bequest or other planned gift, you become part of the select group of community-minded individuals that make up the Community Foundation's Legacy Society.

Ready to make a bigger impact with your giving?

As my husband and I have established our own fund, we have this unique opportunity to be funders and to provide some long-lasting community impact in an area of our choosing.”

As my husband and I have established our own fund, we have this unique opportunity to be funders and to provide some long-lasting community impact in an area of our choosing.”

– Peggy Roberts, donor-advised fundholder