Local Impact Investing

A new tool to create positive change in our region

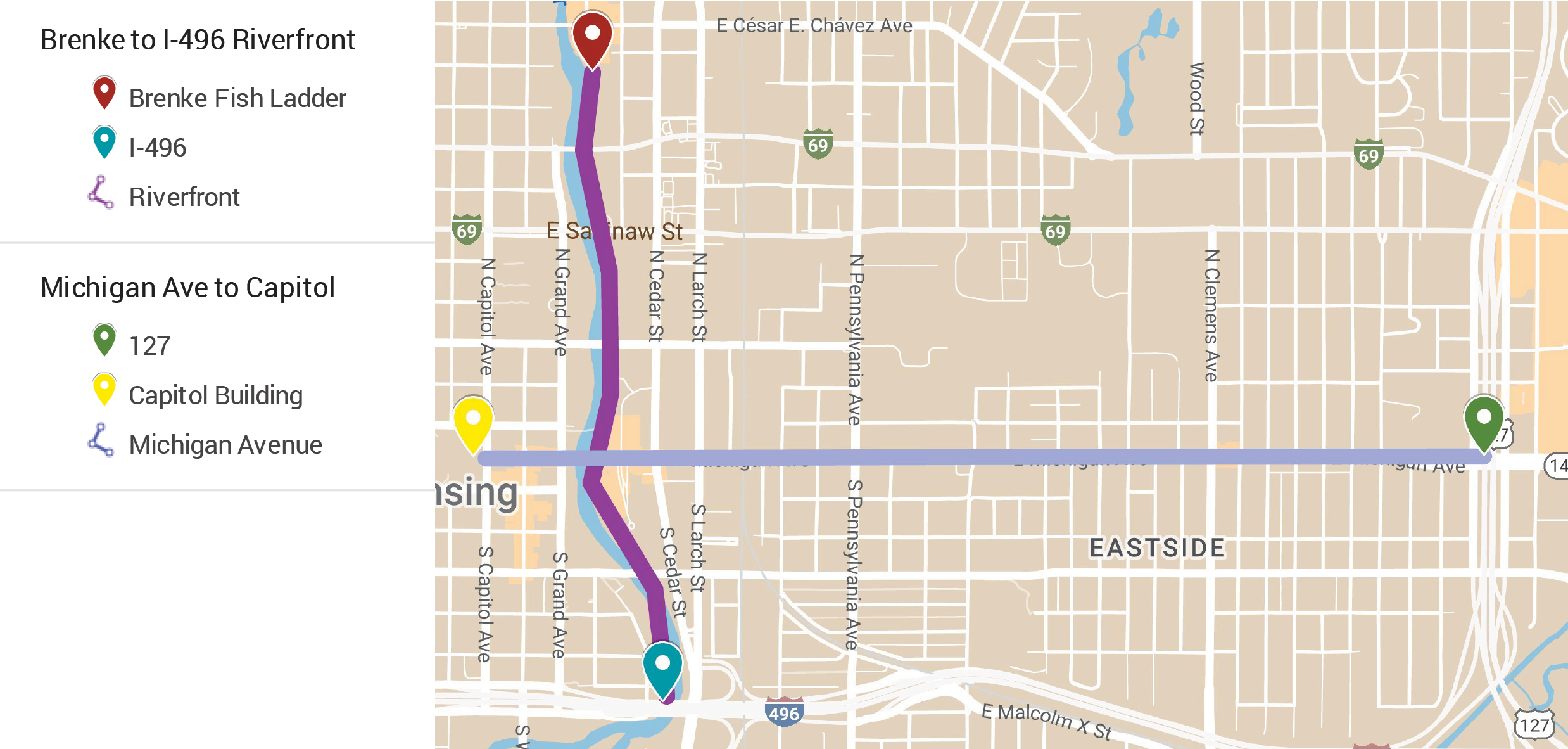

Since 2017, the Community Foundation’s strategic direction has been to create a vibrant region that attracts and retains a talented workforce. To that end, we have led placemaking initiatives along the Michigan Avenue corridor – the backbone of our three-county region – including projects that create a vibrant downtown riverfront.

What’s New

Our region is now facing a severe housing and childcare crisis. We need affordable, attainable workforce housing, as well as quality, affordable childcare for our residents. And, in order to attract new businesses to our region, we must provide housing and childcare for their workforce. It will take a collective effort by government, private, and philanthropic resources to make an impact.

Our Responsibility

The Foundation must do our part to address this crisis, while staying true to our current focus on the corridor. But it will require resources beyond our grantmaking funds to make a difference. That’s where Local Impact Investing comes in. By investing a small portion of our assets here in our community, we can effectively contribute to the solution. For 50 years, foundations across the country have used Local Impact Investing to make positive change in their communities that grantmaking alone could never do.

Different than traditional investing, Impact Investing must generate both a financial return as well as a tangible social or community benefit – in this case, attainable housing and childcare. And unlike grants, investments are loans, repaid to the Foundation with a financial return, then “recycled” back into the community through additional investments.

Why is the Foundation engaging in Local Impact Investing?

Community challenges are complex and often require resources beyond the reach of grantmaking. There is a gap between the need for capital and what the private market will provide. Local Impact Investments will target projects that are not likely to happen without the Foundation’s capital or leverage. Local banks and other financial intermediaries are considered partners, not competitors. The goal of Impact Investing is to create long-lasting and systemic changes. While our biggest needs now are housing and childcare, our impact investments can change over time as our region’s needs shift.

How does it work?

A small percentage (up to 1% annually and 5% total) of our investable assets on Wall Street are carved out for local investments, loaning to nonprofits, for-profits, and intermediary partners. Currently, investments are focused on or near the Michigan Avenue corridor. Investment opportunities within our focus area will be identified by members of the community and evaluated against criteria identified by our Board of Trustees and our Impact Investment Committee.

Who will make investment decisions?

Foundation staff will solicit proposals for investment opportunities and conduct preliminary due diligence. Local banks, credit unions and other lenders, as well as housing, childcare and community development organizations will be asked to help identify important investment opportunities meeting our target criteria. The Foundation’s Local Impact Investment Committee will follow Board-approved policies and guidelines when evaluating proposals. Committee members are local leaders with expertise in lending, investing, community development, and the practice of Local Impact Investing. Ultimately, the Foundation’s Board of Trustees must approve all investment decisions.

Impact Investing Committee

- Jeff Benson, President & CEO, CASE Credit Union

- Bruce Caltrider, Kahl & Caltrider Investment Group of Wells Fargo Advisors

- Roxanne Case, Executive Director, Ingham County Land Bank

- Aurelius Christian, Development Programs Coordinator, Lansing Economic Development Corporation

- John Fifarek, attorney, Lasky Fifarek & Hogan PC

- Fern Griesbach, retired Executive Director of Human Resources, Consumers Energy

- Tom Hofman, retired Director of Human Resources, Granger Waste Services

- Janet Lillie, Assistant Vice President for Community Relations, Michigan State University

- Angelia Salas, Director of Constituency Services, MI Association of Non-Public Schools

- Tim Salisbury, Regional President, PNC Bank

- Rawley Van Fossen, Director of Economic Development and Planning, City of Lansing

Is Impact Investing risky?

All investing comes with risk. However, extensive due diligence, senior lender partners and underwriting on investments will help mitigate risk. External support partners may be contracted to assist in risk mitigation

Who can be part of Impact Investing?

Any business or individual can be part of the Foundation’s Local Impact Investing program:

- Make a tax-deductible gift to the Community Foundation's Local Impact Investment Fund

- Invest from your new or existing donor-advised fund

Our Current Focus Area